How To Download Challan From Income Tax India

Income tax Challan tax jagoinvestor paying interest reciept Challan 280 itns tax income indiafilings

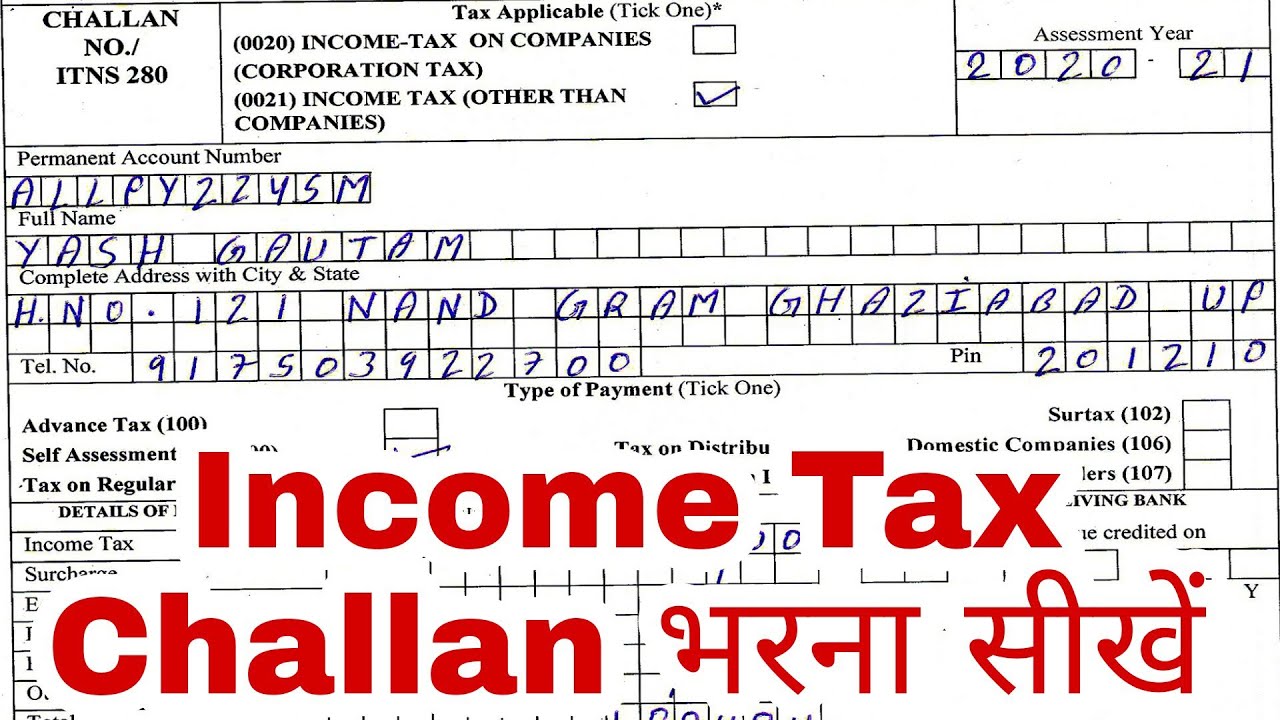

HOW TO FILL INCOME TAX CHALLAN 280 OFFLINE - YouTube

Tds challan online payment tds challan tds challan form tds Income tax payment challan (guide) Online income tax payment challans

Challan tax

How to fill income tax challan 280 offlineChallan income Tax payment over the counter user manualIncome tax challan procedure online.

Challan tax income status number online payment indiafilings taxpayers identification deposited banks challans track using theirAutomated income tax challan form 280 in excel format up to date Online income tax payment challansOnline income tax payment challans.

How to download tds challan and make online payment

Create challan form (crn) user manualHow to generate challan form user manual Income tax payment challansHow to download paid tds challan and tcs challan details on e-filing.

Income tax challan fillable form printable forms free onlineIncome tax challan Challan taxChallan for payment of tds u/s 194-ia: transfer of immovable property.

Challan 280 in excel fill online printable fillable b

How to generate challan form user manualProcedure after paying challan in tds Challan for paying tax on interest incomeOnline income tax payment procedure.

Challan tds form tax property ia payment immovable transferTds challan procedure return paying after computation update details these our How to pay income tax online : credit card payment is recommended toView challan no. & bsr code from the it portal : help center.

Income indiafilings challan payment

Challan itns 280How to generate challan form user manual Challan income paying offlinePay self assessment tax.

How to generate challan form user manualIncome tax challan .

CHALLAN 280 | Income Tax In India | Payments

HOW TO FILL INCOME TAX CHALLAN 280 OFFLINE - YouTube

How To Pay Income Tax Online : Credit card payment is recommended to

Income Tax Payment Challans - Online Tax Payment - IndiaFilings

Tds Challan Online Payment Tds Challan Tds Challan Form Tds | My XXX

Income Tax Challan Fillable Form Printable Forms Free Online

How to Generate Challan Form User Manual | Income Tax Department

Tax payment over the Counter User Manual | Income Tax Department